Jamie Sabau/Getty Images. Pictured: Cardinals bat weight

Missouri lawmakers pre-filled three bills to permit the state’s first-ever legal retail and online sportsbooks in 2021, setting up the fourth-consecutive year sports betting legislation will be considered in the legislature.

These latest bills show lawmakers largely support multiple, statewide mobile betting options with business-friendly taxes and a competitive, online marketplace. Here are the key differences between the proposals and what to expect for legal sports betting’s prospects in the Show Me State.

Senate Bill 18 (Hoskins)

The bill has high operator access, low tax rates and reasonable licensing fees, but requires sportsbooks to use official league data and pay 0.25% of gross betting handle wagered on pro sports to the respective leagues and the same for college sports to in-state Division I athletic programs, the first-such requirement of any state with legal betting.

- Sponsor: Sen. Denny Hoskins

- Statewide Online Betting Permitted: Yes

- Retail Betting Permitted: Yes

- Eligible Betting Establishments: The state’s 13 casinos

- Online Skin Count: As many as 39, three for each casino

- Regulatory Body: Missouri Gaming Commission

- College Prop Bets Allowed: Yes

- Sportsbook Tax Rate: 9% of adjusted gross revenue

- State Regulatory Fees: $25,000 application fee, $50,000 administration fee every year, $10,000 license renewal every five years

- League Data Fees: Rate not determined, but leagues may request compensation for data used in live or in-play bets

- League Royalty Fees: 0.25% of gross money wagered given to professional leagues for their games, 0.25% on NCAA Division I events given to in-state programs

Overview: The government-imposed licensing fees and tax rates are below the industry average in most other states, a boost to all 13 casinos (and 39 total online partners) eligible under the bill to open sportsbooks. Most other regulatory and other measures are fairly standard, and the statewide mobile access creates a competitive marketplace, assuming all eligible skins are filled.

However, other fees are among the most sports league-friendly (and sportsbook unfriendly) rates in the country. The 0.25% “royalty fee” on handle remitted to all professional sports teams is a major blow in what is already a low margin offering. The 0.25% fee for college events, which only goes to compliance support for Missouri schools’ athletic programs, is a boost for state colleges but a blow to would-be legal sportsbooks.

That’s not to mention the league-data requirement, which like the royalty fees, have been decried by industry stakeholders. A legal betting option means more revenue opportunities for state casinos and tax coffers, but this fee structure could hurt revenue potentials, in turn forcing books to offer non-competitive lines — and force would-be legal customers back to the black market.

Senate Bill 217 (Luetkemeyer)

The bill has even lower tax rates and eschews league “royalty” fees, but would limit online skins and ban proposition bets for college sports.

- Sponsor: Sen. Tony Luetkemeyer

- Statewide Online Betting Permitted: Yes

- Retail Betting Permitted: Yes

- Eligible Betting Establishments: The state’s 13 casinos

- Online Skin Count: At least 13, one for each casino

- Regulatory Body: Missouri Gaming Commission

- College Player Prop Bets Allowed: No

- Sportsbook Tax Rate: 6.25% of adjusted gross revenue

- State Regulatory Fees: $10,000 application fee, $5,000 administration fee every year, $10,000 license renewal every five years

- League Data Fees: Rate not determined, but leagues may request compensation for data used in live or in-play bets

- League Royalty Fees: No

Overview: If this bill passes as written, Missouri would top Nevada for the lowest sports betting tax rate in the country. The state government administration and licensing fees are basically the same as the Hoskins bill, which are also very sportsbook-friendly.

While this bill removes the much-maligned league “royalty” fees, it still requires compensation for official data on live or in-play bets. It also has a specific college prop bet prohibition, which although a relatively small part of most sportsbooks betting handles, still limits a possible legal offering.

Most significantly, it makes no mention of multiple branded online licenses, which would mean a max of only 13 online sportsbooks. This would still mean a competitive marketplace, but some top brands would likely be left out of the market.

Senate Bill 256 (Rowden)

The tax and licensing rates are slightly higher than the Luetkemeyer bill, but it doesn’t have the prop betting ban or Hoskins’ bill’s royalty fee mandate, plus allows far greater market access

- Sponsor: Sen. Caleb Rowden

- Statewide Online Betting Permitted: Yes

- Retail Betting Permitted: Yes

- Eligible Betting Establishments: The state’s 13 casinos

- Online Skin Count: As many as 39, three for each casino

- Regulatory Body: Missouri Gaming Commission

- Individual College Player Prop Bets Allowed: Yes

- Sportsbook Tax Rate: 6.75% of adjusted gross receipts

- State Regulatory Fees: $50,000 application fee, $20,000 administrative fee every year, $10,000 license renewal every five years

- League Data Fees: No, but leagues may request to limit, restrict or prohibit bets placed on their events

- League Royalty Fees: No

Overview: This could be the most favorable bill in sportsbooks’ eyes. The state-imposed fees are still among the lowest in the nation, plus it avoids any extra royalty fee burdens or prop betting restrictions. More importantly, it would allow as many as 39 sportsbooks to enter the state, which would be among the highest skin totals of any state in the country

Leagues could ask to limit or exclude bets on their events under this bill, but all-in-all, it creates a favorable market environment and what would appear to be the industry’s preferred option heading into next month’s legislative session.

Will Missouri Sports Betting Be Legal in 2021?

Missouri sports betting seems to have a better chance than ever as it’s set to be debated for a fourth-straight legislative session.

Hoskins’ and Rowden’s 2021 bills are identical to their respective 2020 proposals, both of which were discussed in committee this year. That pair, along with the Luetkemeyer bill, are substantially similar to sports betting legislation considered in 2019 and 2018 as well.

At least one of these bills seemed likely to pass earlier this year before it fell to the wayside due to the COVID-19 pandemic, which curtailed the regular legislation this spring and shuttered a special session this fall. The virus looms large heading into 2021, but it could be a catalyst for a new revenue opportunity such as sports betting in a state facing a major budget shortfall.

_BookPromo=58

Critically, the three Senate bills are largely aligned on major issues such as government tax rates and online authorization, issues that have derailed legislation in other states. Unlike the past three years, no Representatives in the House have introduced legislation of their own, but it could help streamline the process to have talks originate in just one chamber.

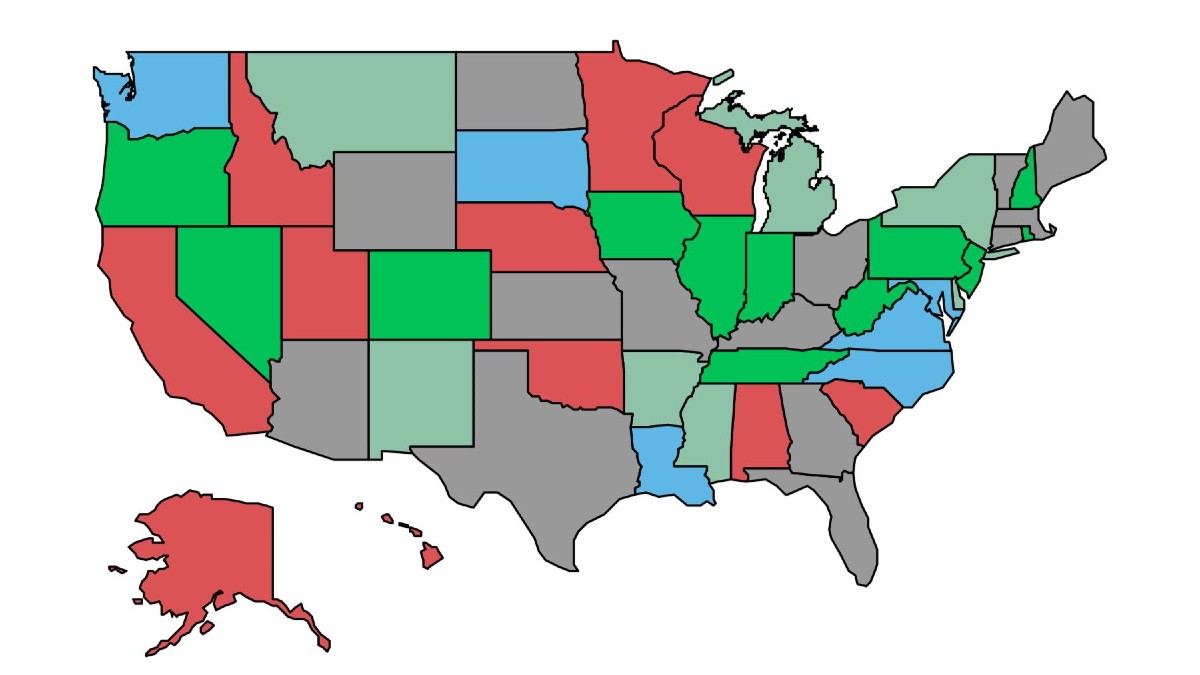

Missouri also enters 2021 with legal mobile wagering in neighboring Illinois, Tennessee and Iowa. With Kansas set to reconsider its mobile betting legislation next year as well, Missouri lawmakers have more external pressure than ever to pass a bill of their own.

These factors are all conducive for a (relatively smooth) legislative process going forward, and multiple speakers at recent industry conferences have considered Missouri among the states most likely to legalize betting next year.

The legislative process is seldom easy, as Missouri’s recent failed sports betting efforts have reaffirmed, but the framework laid out by the newest proposals is another bullish sign toward 2021 passage.